Welcome to the

Institute for Systemic Financial Professionals™

A future where financial advisors, planners, coaches, educators, and financial therapists are equipped to address the multiple dimensions of money, fostering wellness and systemic insight across generations.

What is Systemic Financial Planning?

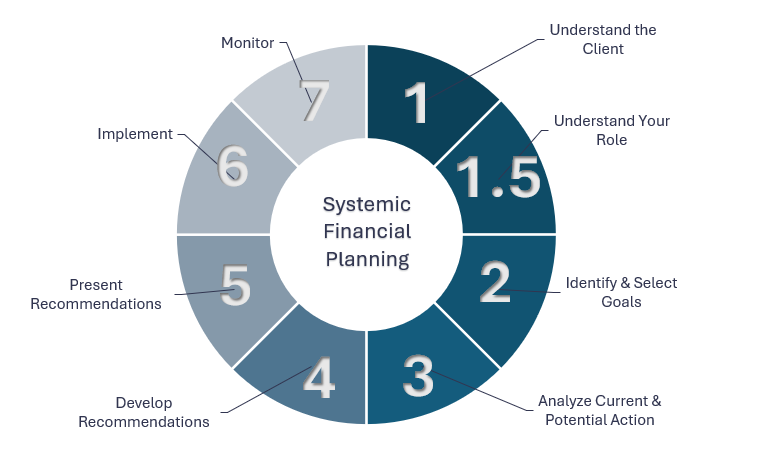

The CFP Board outlines the seven steps to the financial planning process starting with understanding the client’s financial and personal situation and ending with continuous monitoring of the financial plan. Within each of the original seven steps, there is opportunity to expand the perspective to incorporate systemic elements. Applying a systemic approach to financial planning requires self-awareness of how you, the professional, are part of the client system and how you influence outcomes both explicitly and implicitly through your words, tone, and actions.

1 Systemic Approach to Understanding the Client: To get to know a client’s circumstances starts with understanding the “system.” The system includes your client and the important people in their life. A systems approach involves listening with your eyes to understand what is not said. To fully understand a person means paying attention to the process and the content.

1.5 Systemic Approach to Understanding Your Role in the System (a new systemic step to the traditional process): Once you have a solid understanding of the client’s system, you start to recognize how you are part of the system, too. In this step, you will increase your self-awareness to know how your emotions and biases influence client interactions and outcomes.

2 Systemic Approach to Identifying and Selecting Goals: To identify goals means understanding the “why” or values held by clients. No goal will be followed unless it is authentic to the client. A systemic approach to goals focuses on desirable outcomes that align with the client’s values. Possible outcomes that clients may identify include better financial wellness, living more authentically, and better communication with family/"the system" about money.

3 Systemic Approach to Analyzing Current and Potential Action: Pay attention to the emotional reactions with your conversations with clients and be ready to pause if the clients’ mentality prevents them from hearing what you are saying. In this step, you can manage emotional reactions through careful tools and discussion prompts.

4 Systemic Approach to Developing Recommendations: A Systemic Financial Professional™ sees more of what is going on with clients’ lives. As a result of this expanded perspective, be sure to recognize your limits and make referrals that are utilized by the clients. A recommendation may be to collaborate with other professionals or to make a referral to an outside professional to complement the work of financial planning.

5 Systemic Approach to Presenting Recommendations: Small changes are more likely to be followed than massive shifts in current behavior. Consider a staged approach to your recommendations.

6 Systemic Approach to Implementing Recommendations: When implementing goals, it is important to keep the client’s readiness for change at the front of mind. Tailor communication to the appropriate stage for the client’s readiness for change.

7 Systemic Approach to Monitoring the Plan: Financial planning is an ongoing process and monitoring client systems is just as dynamic. When reviewing progress toward goals, take process notes to capture what is not being said and note changes to the client system.

Founder, Dr. Sonya Lutter, created the Institute for Systemic Financial Professionals™ based on her marriage and family therapy training and wanting to do something to support established financial professionals in their quest for something more. Her mission supports the roots of why she co-established the Financial Therapy Association almost 20 years ago—to help advisors communicate therapeutically without being a therapist.

The Institute for Systemic Financial Professionals™ is a place for financial professionals to gain knowledge in family system’s theory and practice applying the principles with themselves and their clients.

Gain confidence in addressing difficult client issues with the Foundations course. You will learn a process for implementing your skills into practice alongside a small cohort of peers.

Continue your professional journey with the interdisciplinary integration of systems theory, therapeutic communication, and the psychology of financial planning after the course ends.

Dr. Daniel Crosby

Chief Behavioral Officer, Orion

“The Institute for Systemic Financial Professionals™ offers a fresh and much-needed perspective in advisor training. Dr. Sonya Lutter brings a rare blend of academic depth and practical understanding of family systems theory that adds real substance to the work.

As someone who’s spent a career at the intersection of psychology and money, I see this program as an important step forward. It goes well beyond technical skills to address the emotional and relational side of financial decision-making—the side that often matters most.

By integrating systems thinking, therapeutic communication, and holistic planning, this training equips advisors to better serve the real humans behind the spreadsheets.”

Is this for me?

You have built a successful solo practice and are technically skilled, but feel like something is missing when dealing with clients whose money issues are emotionally or relationally complex.

-

The systemic framework addresses difficult issues like divorce, grief, and major life transitions. You do not have to become a therapist to communicate therapeutically. If you are ready for the next step, we are ready for you.

-

The Systemic Financial Professional training covers 8-modules at the cost of $5,000. You will engage with peers throughout your learning and participate in live conversations with the facilitator, Dr. Sonya Lutter.

You are engaged with community-based financial literacy work and have a boutique coaching practice focused on money and values. You are wondering why clients are not following your advice.

-

Get ideas for new activites centered around a family system’s perspective. You will learn about readiness for change and be ready to facilitate more robust education and coaching.

-

The Systemic Financial Professional training covers 8-modules at the cost of $5,000. You will engage with peers throughout your learning and participate in live conversations with the facilitator, Dr. Sonya Lutter.

You are part a family office that handles complex estate and succession issues. Recently, you have noticed that technical expertise is not sufficient in moving family converations forward.

-

You might have a mental health professional on staff or have a good set of referrals for really difficult situations. For the in-between stuff, learn how to better facilitate converations to reduce conflict and increase empathy with the SFP training.

-

The Systemic Financial Professional training covers 8-modules at the cost of $5,000. You will engage with peers throughout your learning and participate in live conversations with the facilitator, Dr. Sonya Lutter.

Become a Systemic Financial Professional™

The Institute for Systemic Financial Professionals™ is more than technical training—we develop whole-person thinkers. Technology assists planning, but systems-based thinking drives transformation.

With upgrades to the traditional financial planning process, you can communicate therapeutically without becoming a therapist.

-

The financial planning process (according to the CFP Board) starts with Understanding the Client’s Personal and Financial Circumstances. In addition to the financial data that is a natural part of the planning process, the personal elements are typically limited to basic demographic data. A systemic process brings in that missing element of family system dynamics.

Words like “holistic” or “comprehensive” could describe the process of understanding where the client is coming from. A systems process goes a bit further to understand the core of the issue. In this section, you will learn how to listen with your eyes to understand what is not said.

-

Step 1.5 is NEW to the traditional financial planning process. A key element of applying a therapeutic approach is knowing that YOU are part of the system. “You can only take the client as far as you have gone,” people say. This is it. Understand your role to better manage client dynamics and outcomes.

A systemic process goes further than a single relationship to understand the core of the issue. Try to listen with your eyes to understand what is not said.

Increase self-awareness to know how your emotions and biases show up with your clients. You are part of the system. -

To identify goals means understanding the “why” or values held by clients. No goal will be followed unless it is authentic to the client. A systemic approach to goals focuses on desirable outcomes that align with the client’s values. Possible outcomes that clients may identify include better financial wellness, living more authentically, and better communication with family/"the system" about money.

-

Pay attention to the emotional reactions with your conversations with clients and be ready to pause if the clients’ mentality prevents them from hearing what you are saying. In this step, you can manage emotional reactions through careful tools and discussion prompts.

-

Steps 4-6 of the financial planning process are largely rooted in the financial calculations. Since a Systemic Financial Professional™ sees more of what is going on with clients’ lives. As a result of this expanded perspective, we will evaluate limits to your professional boundaries and develop a solid referral system to consider as you develop, present, and implement the financial plan.

-

Financial planning is an ongoing process and monitoring client systems are just as dynamic. When reviewing progress toward goals, take process notes to capture what is not being said and note changes to the client system.

Jodi Kaus, JD, CTFA

Director of Program Implementation, Peer PowerED Financial Wellness™

“As a financial planner and trainer of future financial professionals, I have witnessed the difference in satisfaction and follow-through by clients when their advisor considers them holistically and understands how their financial wellness impacts, and is impacted by, other areas of their wellness. These tools give advisors the confidence to help clients open up and share their most valuable insights leading to optimal success for all parties.”

Jared Anderson, Ph.D., LCMFT

“This training challenges financial professionals to see themselves as part of the system, not separate from it, and that shift changes everything. By developing greater self-awareness and learning how to engage with clients more thoughtfully, planners become better equipped to support not just financial goals, but the people behind them.”

Contact Us

Fill out some info and we will be in touch shortly. We can’t wait to hear from you!